Did Galeterone ARMOR2 Prostate Cancer Data Impress at ESMO 2014?

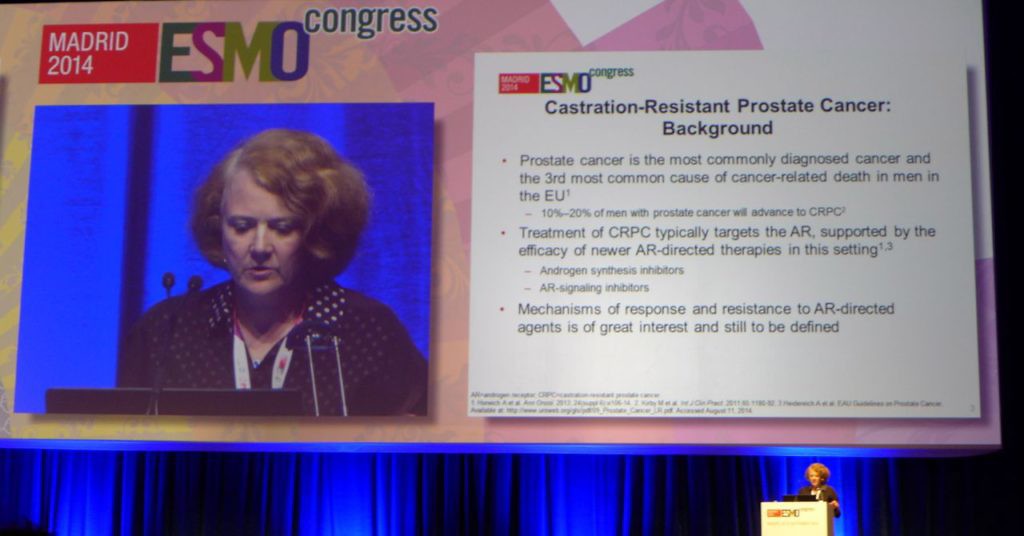

At the 2014 ESMO Congress in Madrid, Mary-Ellen Taplin, MD (Dana-Farber Cancer Institute, Boston) presented the results of the Tokai Pharmaceuticals (NASDAQ $TKAI) ARMOR2 clinical trial of galeterone in men with advanced prostate cancer.

Galeterone has a novel triple mechanism of action. In effect, it is a CYP17 lyase inhibitor (like abiraterone) that has additional anti-prostate cancer actions including androgen receptor (AR) inhibition (like enzalutamide). It also causes AR degradation that decreases AR levels.

Tokai’s IPO last month is reported by Renaissance Capital to have raised $98M for the company, with most of the funds going to prior investors including Novartis Bioventures which owned 28 percent.

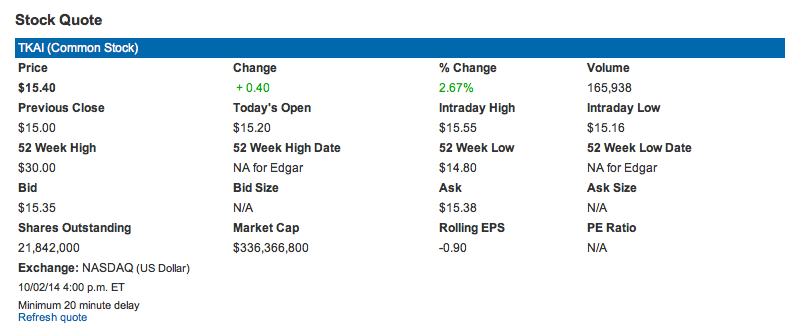

Shares in $TKAI were initially priced at $15. They soared to a high of $30 thanks to high insider buying and a high trading volume. Novartis Bioventures were reported by Renaissance to have bought $20M.

As of publishing this post, the stock is now trading at $15.40, slightly above it’s IPO price. So have Novartis and others made a good investment?

The market cap of $TKAI, according to their Investor Relations page (screenshot pre-market Oct 3, 2014 shown above) is $336M – not high for a company about to enter phase III drug development.

The market cap of $TKAI, according to their Investor Relations page (screenshot pre-market Oct 3, 2014 shown above) is $336M – not high for a company about to enter phase III drug development.

Readers are no doubt aware of the Feuerstein-Ratain rule that predicts a phase III cancer trial will be a failure when undertaken by a company with a market cap less than $300M. As Adam noted in his May 6 story on The Street earlier this year, “For companies with market caps between $300 million and $1 billion, the oncology phase III success rate is 59%.”

The big questions now are did the data for galeterone from the ARMOR2 trial impress at ESMO 2014 in Madrid and what are the challenges and opportunities in the planned phase III ARMOR3-SV trial?

Subscribers can login to read more.

DISCLAIMER: Please note this piece offers no stock advice, is not a solicitation to invest in $TKAI and makes no recommendation on whether to buy or sell. It merely offers commentary and analysis of the data presented at ESMO 2014. Readers should do their own due diligence prior to making any investment decision.

This content is restricted to subscribers

At ASCO GU this week (

At ASCO GU this week (