Earlier this week Bayer & Algeta announced that Alpharadin™ (radium-223 chloride) had received Fast Track designation from the FDA for the treatment of castration-resistant prostate cancer (CRPC).

Bayer signed an agreement with Norwegian based Algeta in 2009 for the global commercial rights to Alpharadin™, with Algeta retaining a 50/50 co-promotion and profit-sharing in the United States.

According to the Algeta August 23, 2011 press release, in light of the FDA fast track designation they plan on filing for United States approval in mid-2012, ahead of previous expectations.

At the ASCO annual meeting in Chicago this year, phase II clinical trial data for Alpharadin™ was presented during the poster session (Abstract #4620). You can obtain a copy of the poster here.

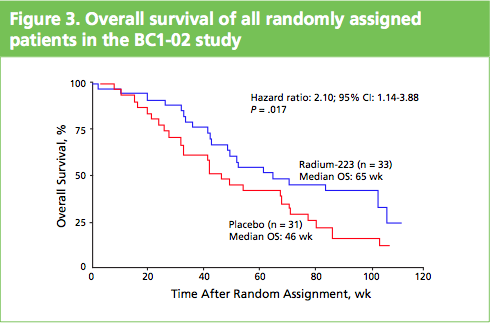

ASCO Alpharadin™ Phase 2 Data showed increase in Overall Survival

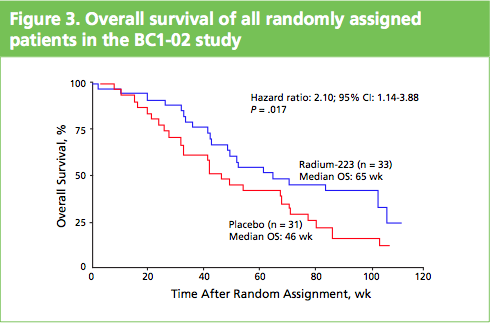

What impressed me when I saw the poster and talked to Gillies O’Brien-Tear, the Chief Medical Officer for Algeta, was the increase in overall survival (OS) seen. In the phase 2 study presented, Alpharadin™ improved OS by 4.5 months versus placebo when added to the standard of care in patients with CRPC and bone metastases.

To me this stands out from other drugs that are targeting bone metastases in CRPC, such as cabozantinib (XL184) and denosumab (Xgeva®), where to my knowledge no overall survival benefits have yet been seen.

Despite the lack of OS benefit, Amgen announced earlier this week on Aug 22nd, they had made a supplemental BLA application for denosumab to expand the indication to include the prevention of bone metastases in CRPC. The PDUFA date is April 12, 2012.

Will Xgeva® and Alpharadin™ be viewed as potential competitors or used synergistically? It will be interesting to see any data that shows the impact of Alpharadin™ on bone pain and quality of life, and how physicians view the new treatment options that may be available to them.

How does Radium-223 chloride act?

It is a calcium mimetic that is taken up by bone, where the radium then emits alpha-particles that act on the prostate cancer bone metastases. The radiation is only short range (2-10 cell diameters) which limits its toxicity to healthy tissue and results in localized and focused radiation that kills metastatic cancer cells in the bone.

The day after the phase 2 results were presented at ASCO, Algeta and Bayer announced on June 6, positive data from the interim analysis of the phase 3 ALSYMPCA (ALpharadin in SYMptomatic Prostate CAncer patients) trial.

This study began in June 2008, with enrollment of 922 patients completed in January 2011. According to the June 6 press release, the interim analysis of the ALSYMPCA trial showed a statistically significant increase in overall survival in CRPC patients receiving Alpharadin™ compared to placebo.

Median overall survival was 14.0 months for Alpharadin™ and 11.2 months for placebo (two-sided p-value = 0.0022, HR = 0.699)

As a result of the interim analysis, the independent data monitoring committee recommended that the trial be stopped and patients on the placebo arm offered treatment with Alpharadin™. Dr Chris Parker, from the Royal Marsden Hospital, and Principal Investigator of ALSYMPCA, said:

“Based on the observed survival benefit and its safety profile, Alpharadin may become an important treatment for patients with bone metastases from advanced prostate cancer.”

At the forthcoming European Multidisciplinary Cancer Congress in Stockholm (co-sponsored by ECCO, ESMO and ESTRO), the phase III Alpharadin data for the ALSYMPCA trial will be presented as a late breaking abstract on September 24, 2011 in the Presidential Session.

The abstracts for the meeting are not yet available, but in the light of the FDA Fast Track designation earlier this week, and the fact the ALSYMPCA trial results will be presented in a plenary session at Stockholm, positive data is expected.

The prostate cancer market is certainly heating up with the approval earlier this year of Zytiga™ (abiraterone acetate) and several products in late stage development such as Alpharadin™, MDV3100, TAK-700 and custirsen (OGX-011). It’s good news for patients that new treatment options may be available before too long. As to how these new therapies are used, sequenced and combined, that is set to be the topic of conversation at medical and scientific meetings over the coming year.

Part of the PPACA signed into law by President Obama on March 23, 2010 was the Biologics Price Competition & Innovation Act (BPCI).

Part of the PPACA signed into law by President Obama on March 23, 2010 was the Biologics Price Competition & Innovation Act (BPCI). Jeffrey Engelman from MGH persuasively presented on why we need combination therapies to overcome resistance. He noted that:

Jeffrey Engelman from MGH persuasively presented on why we need combination therapies to overcome resistance. He noted that: Prostate cancer is the second leading cause of cancer death in men, so it was good news this morning when Medivation & Astellas issued a

Prostate cancer is the second leading cause of cancer death in men, so it was good news this morning when Medivation & Astellas issued a

At the ASCO 2011 meeting in Chicago there was

At the ASCO 2011 meeting in Chicago there was  What makes Alpharadin exciting as a new treatment option for castration resistant prostate cancer (CRPC) is that the ALSYMPCA trial data shows that it not only provides a significant median overall survival (OS) benefit of 2.8 months compared to placebo (14 months versus 11.2 months, p=0.00185, HR 0.695), but significantly delays the time to first skeletal event by 5.2 months (13.6 months versus 8.4 months, p=0.00046, HR 0.610).

What makes Alpharadin exciting as a new treatment option for castration resistant prostate cancer (CRPC) is that the ALSYMPCA trial data shows that it not only provides a significant median overall survival (OS) benefit of 2.8 months compared to placebo (14 months versus 11.2 months, p=0.00185, HR 0.695), but significantly delays the time to first skeletal event by 5.2 months (13.6 months versus 8.4 months, p=0.00046, HR 0.610).

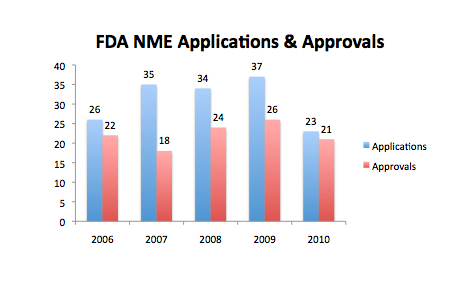

Source: redrawn from FDA Center for Drug Evaluation and Research (CDER) presentation. The data in my opinion is a little ambiguous as to the true state of the Pharma industry. While the number of applications declined last year to a five year low of 23, from a previous 5 year high in 2009 of 37, the number of NME approvals at 21 was only just below the 5 year average of 22.

Source: redrawn from FDA Center for Drug Evaluation and Research (CDER) presentation. The data in my opinion is a little ambiguous as to the true state of the Pharma industry. While the number of applications declined last year to a five year low of 23, from a previous 5 year high in 2009 of 37, the number of NME approvals at 21 was only just below the 5 year average of 22.