Merck’s cathepsin-K inhibitor odanacatib in osteoporosis

Following on from my recent blog post on emerging treatments in osteoporosis, one of new approaches in development is the inhibition of cathepsin-K.

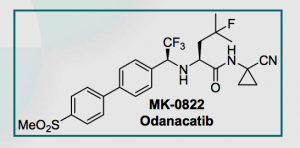

Cathepsin-K inhibition is a novel approach to osteoporosis treatment and Merck’s odanacatib is leading the way in this new class of drugs. It is currently in phase III development, with 16,716 subjects enrolled (NCT00529373).

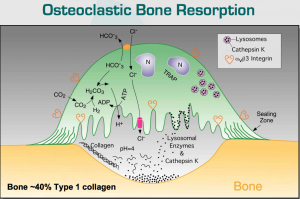

Cathepsins are lysosomal proteases. Cathepsin K (Cat-K) is a cysteine protease that plays an important role in the function of osteoclasts (the cells responsible for bone destruction). Cat-K acts to degrade bone collagen. By inhibiting it, the removal of bone matrix proteins by osteoclasts is reduced.

However, Cat-K inhibitors such as odanacatib do not kill off the osteoclast, but allow it to still produce chemokines and growth factors such as WNT that are responsible for the effective function of osteoblasts (the cells responsible for bone formation).

The net result is that Cat-K inhibitors reduce bone resorption.

Phase II clinical trial results for odanacatib presented at the American Society of Bone and Mineral Research (ASBMR) annual meeting last year (abstract #1247), showed an increase in spine and hip bone mineral density (BMD) after four years of follow-up, suggesting that odanacatib use leads to increased bone strength. As reported by Merck in their press release:

In postmenopausal women who received odanacatib 50 mg weekly for four years (N=13), an increase in BMD of 2.8 percent at the lumbar, and 2.7 percent at the hip were demonstrated between years three and four of treatment. Over four years of treatment, these women had increases in lumbar spine (10.7 percent) and hip (8.3 percent) BMD from baseline.

If you are looking for further information on the science, the February 2011 issue of “The Journal of Bone and Mineral Research” has several papers on odanacatib, osteocytes and cathepsin K inhibitors.

If you are looking for further information on the science, the February 2011 issue of “The Journal of Bone and Mineral Research” has several papers on odanacatib, osteocytes and cathepsin K inhibitors.

Merck has 16,716 subjects enrolled in their phase III trial for odanacatib, and July 2012 is indicated as the date when data will be available for the primary end-point of reduction in fracture risk over the three year treatment period. We can expect the phase III results shortly after that, and if positive, an FDA approval could be expected in 2013.

The development of odanacatib by Merck is clearly a strategy to combat generic alendronate, which has eroded Merck’s market share and profits for Fosamax. Both odanacatib and generic alendronate, are once weekly doses. The timeline for a product launch for odanacatib appears to be in the late 2013/2014 period, and I am sure further clarity on this will appear from Merck nearer the time.

The challenge for odanacatib is that by 2015, analysts estimate that Amgen’s RANKL inhibitor denosumab will be a blockbuster (more than $1 billion in sales) and sales of parathyroid hormone analogues will have tripled to $1.4 billion.

Although the market opportunity in osteoporosis is likely to grow given the aging population around the world, it remains to be seen how the cost/benefit of odanacatib will stack up against the competition, and whether Merck can capitalize on this.