According to a forthcoming article published in Forbes, excerpts of which appear on Matthew Herper’s blog “The Medicine Show,” big pharma should take bigger risks and outsource R&D to smaller, innovative companies.

At least that’s the philosophy of Bernard Munos, the former Lilly sales executive who has focused on the innovation problems faced by the pharmaceutical industry. According to Forbes, he believes that big pharma should “cut research and development” and “rather than do research in house, companies should close their labs and outsource the work to tiny, nimble startups that can explore bigger, crazier ideas.”

However, as Munos goes on to say in an excerpt published by Matthew Herper:

“You cannot script innovation,” Munos says. “You cannot boil it down to a code of best practices. Because it is unpredictable and the opportunities in science do not match the opportunities in markets.”

That is why Munos’ strategy of outsourcing drug discovery may not be the right one – there is no formula that you can give a vendor on how to be innovative. Indeed, leveraging the innovation of small biotechnology companies is nothing new – isn’t that what big pharma already does with its licensing deals and alliances?

The question that comes to mind from the provocative Forbes article is whether innovation of drug development is a service like clinical trials that can be outsourced? Contract Research Organizations (CRO) are now the route by which the majority of companies conduct clinical research. They possess the efficiency and economies of scale to do what is a mundane, process driven task of setting-up, monitoring and processing data associated with a clinical trial on a global basis. Those models works reasonably well and are now the norm. Standard Operating Procedures (SOPs) exist for everything a CRO does in what is a heavily regulated process of gathering data for regulatory submissions.

Is this the same for drug discovery? I am not so sure. Firstly, if you outsource you have to give direction. You have to have a commercial or scientific target, and resources have to be allocated accordingly. Who decides where R&D investment should be spent? Ultimately in any outsourced venture, the company spending the money makes that decision. So all you are doing is shifting the execution of the task, not the development of the strategy, which is where the innovation needs to take place.

Indeed, if one looks at the clinical trial service model, what has happened is that consolidation of small and medium size CRO’s continues to take place. Small companies simply lack the resources to get the job done. I am not convinced that small is necessarily best when it comes to drug discovery.

What’s more, Munos, in the recent Science Translational Medicine (STM) commentary on innovation that he wrote with William Chin, appears to argue for a different model than the one he proposes in Forbes. He states that:

“pharmaceutical companies cannot mitigate risk adequately by pursuing “safe” incremental innovation, instead the industry should reengage in high risk discovery research on a broad scale and only take genuine breakthroughs to the clinic.”

This is easy to say in practice, and may not be a realistic strategy when there is money and sales to be made from me-too and follow-on compounds. How many companies are going to say we are not going to continue with this business model?

According to Munos in Science Translational Medicine (STM) the options open to big pharma are to:

- Participate more decisively in collaborative networks

- Form precompetitive consortia and other partnerships to share costs

- Adopt new research models such as public-private partnerships

To me, there seems to be a disconnect between what Munos says in the Forbes article and what he says in his STM commentary. If he has a clear vision for the future of pharma innovation, he should at least be consistent.

Where I do agree with Munos is the conclusion of his STM commentary that success starts with breakthrough science. This message was also clearly stated at BIO 2011 by the panel on innovation that included GSK’s Moncef Slaoui.

Pharma R&D $ needs to be spent more wisely. In my opinion there is a role for incremental, as well as breakthrough, innovation. The two are not mutually exclusive.

Is cutting R&D and outsourcing discovery the route to success as Munos suggests in Forbes? Only time will tell as pharma R&D retools and refocuses for the future.

Munos, B., & Chin, W. (2011). How to Revive Breakthrough Innovation in the Pharmaceutical Industry Science Translational Medicine, 3 (89), 89-89 DOI: 10.1126/scitranslmed.3002273

Munos, B., & Chin, W. (2011). How to Revive Breakthrough Innovation in the Pharmaceutical Industry Science Translational Medicine, 3 (89), 89-89 DOI: 10.1126/scitranslmed.3002273

Here we kick off 2022 with a philosophical look at what may be needed if we want to move the chains in a meaningful way.

Here we kick off 2022 with a philosophical look at what may be needed if we want to move the chains in a meaningful way.

One of the

One of the

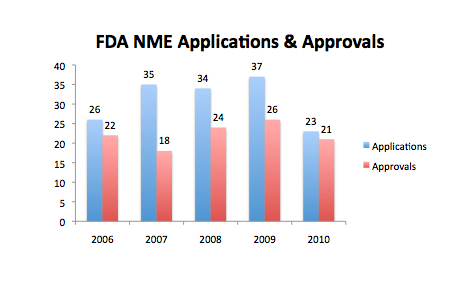

Source: redrawn from FDA Center for Drug Evaluation and Research (CDER) presentation. The data in my opinion is a little ambiguous as to the true state of the Pharma industry. While the number of applications declined last year to a five year low of 23, from a previous 5 year high in 2009 of 37, the number of NME approvals at 21 was only just below the 5 year average of 22.

Source: redrawn from FDA Center for Drug Evaluation and Research (CDER) presentation. The data in my opinion is a little ambiguous as to the true state of the Pharma industry. While the number of applications declined last year to a five year low of 23, from a previous 5 year high in 2009 of 37, the number of NME approvals at 21 was only just below the 5 year average of 22.