The December 17, 2010 issue of “Science” has the catchy of title of “Insights of the Decade”, one of which is an article by Jennifer Couzin-Frankel, “Inflammation Bares a Dark Side”, that describes the ubiquitous role of inflammation. She concluded that:

The December 17, 2010 issue of “Science” has the catchy of title of “Insights of the Decade”, one of which is an article by Jennifer Couzin-Frankel, “Inflammation Bares a Dark Side”, that describes the ubiquitous role of inflammation. She concluded that:

“Mediating inflammation in chronic diseases is a new frontier, its success is still uncertain.”

Inflammation has been shown to play an important role in multiple chronic illnesses such as cancer, and in type 2 diabetes it promotes insulin resistance and the death of pancreatic beta cells. In 2007, Marc Donath and colleagues published a landmark study in the New England Journal of Medicine where he used the drug anakinra, in patients with type 2 diabetes, to block interleukin-1 (IL-1), a cytokine that mediates the inflammatory response. The conclusion of the paper was that:

“The blockade of interleukin-1 with anakinra improved glycemia and beta-cell secretory function and reduced markers of systemic inflammation.”

The finding that diabetes patients whose inflammatory response was blocked did better, has led several companies to work on drug development in this area.

One of these is the biotechnology company, Xoma, whose stocked jumped 200% in the week before Christmas. Although there was no press release or announcement of any company news, it looks like investors decided to take a gamble that the phase 2 trial results for Xoma 052 in type 2 diabetes will be positive. As often happens, the wisdom of the crowd, led to others joining the share buying frenzy.

Source: Google Finance.

Xoma had previously announced on November 4, 2010 (emphasis added) that accrual was complete in the Phase 2a trial of XOMA 052 in subjects with Type 2 diabetes:

“This randomized, placebo-controlled trial, in which 74 patients were enrolled, is designed to evaluate extended biologic activity and safety of XOMA 052. Outcomes will include diabetes measures such as hemoglobin A1c, or HbA1c, and fasting blood glucose, or FBG, and C-reactive protein, or hsCRP, a biomarker of inflammation associated with cardiovascular risk. Interim results from the first three months of treatment in this six month trial are expected to be announced in the first half of January 2011.

Enrollment completed in Phase 2b trial of XOMA 052 in patients with Type 2 diabetes. This randomized, placebo-controlled dose-ranging trial enrolled 420 patients and is designed to further evaluate the safety and efficacy of XOMA 052 dosed once monthly compared to placebo. The results will include data on measurements of HbA1c, FBG and hsCRP. Top line results are expected to be announced in the first quarter of 2011.”

XOMA 052 is a high affinity monoclonal antibody that targets the inhibition of IL-1 beta. Its ultra-high affinity allows for monthly dosing and lower dose levels which supports patient compliance in chronic diseases. Positive phase 2 results for XOMA 052 in Behcet’s Uveitis was presented in November to the American College of Rheumatology.

XOMA 052 is a high affinity monoclonal antibody that targets the inhibition of IL-1 beta. Its ultra-high affinity allows for monthly dosing and lower dose levels which supports patient compliance in chronic diseases. Positive phase 2 results for XOMA 052 in Behcet’s Uveitis was presented in November to the American College of Rheumatology.

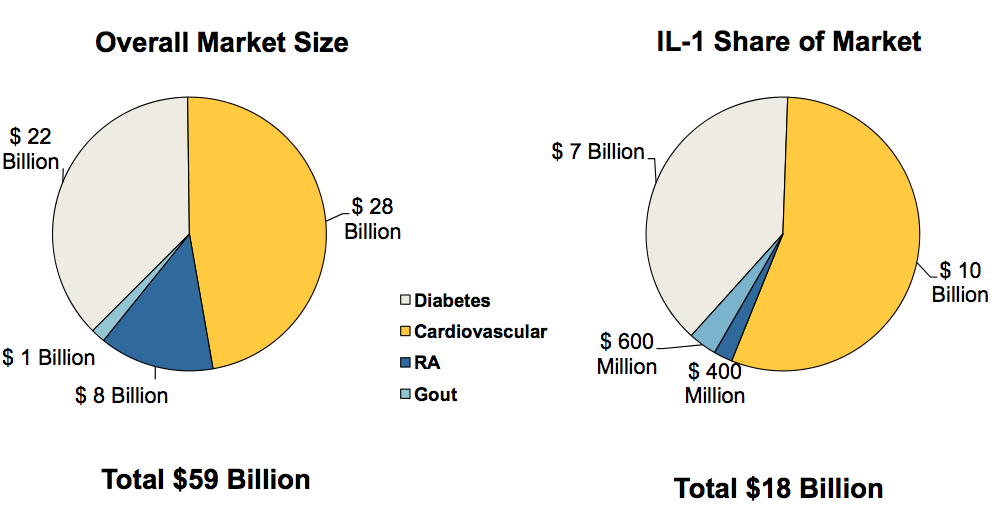

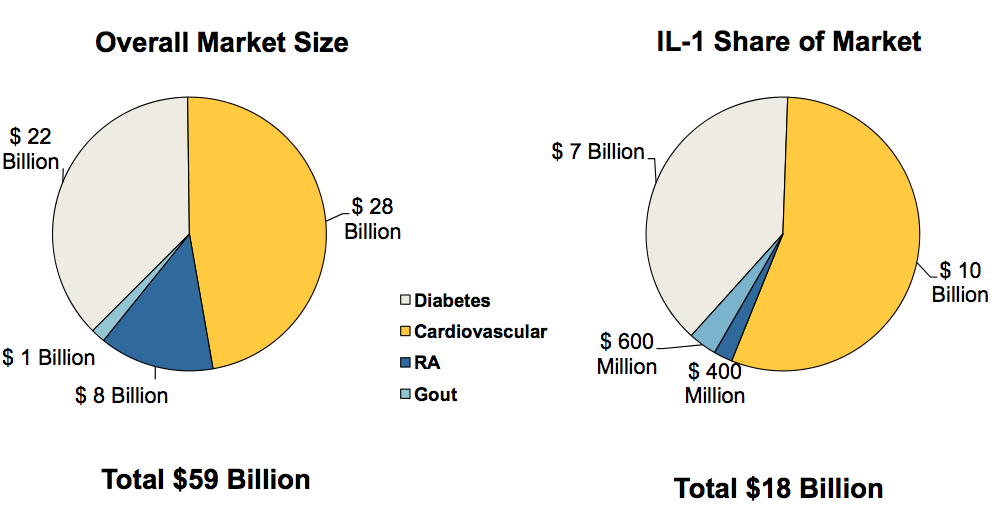

According to the November 2010 Xoma Corporate Presentation, the overall market size for diabetes is $22B, of which the IL-1 share is $7B, raising the possibility that XOMA 052 could be a blockbuster if shown to be safe and effective.

Source: Xoma November 2010 Corporate Presentation

Source: Xoma November 2010 Corporate Presentation

Whether these numbers are realistic or ‘pie-in-the-sky’ dreams remains to be seen and we will have to wait and see what happens with future study readouts.

Note: Additional information on the deal with Servier can be found here.

Update March 18th 2014 by @maverickny

FDA awarded Xoma and Servier orphan drug designation for XOMA 052 (gevokizumab) for the treatment of pyoderma gangrenosum (PG), a rare disease that induces painful skin ulcers. Standard therapy involving corticosteroids or cyclosporin are effective in approx. half of patients, but for those that relapse this new approach may offer new treatment options.

The two companies previously signed development and financial agreements including a 2011 agreement to commercialize XOMA 052, an anti-inflammatory drug candidate and another in 2013 to start the Proof-of-Concept (POC) clinical program to study gevokizumab.

Earlier this month, Xoma provided an update on its gevokizumab development program:

“Based on results from the Company’s Phase 2 program in patients with erosive osteoarthritis of the hand (EOA), XOMA does not intend to launch pivotal development for the broad EOA indication. The Company will conduct a review of the full dataset to determine if there is a segment of the patient population that best responds to gevokizumab therapy prior to initiating any potential additional clinical studies in this indication.”

The phase 3 program for gevokizumab in patients with pyoderma gangrenosum thus looks to be the best shot they have with this agent at present.

Update August 28th 2017 by @maverickny

Novartis have acquired the rights to Xoma’s gevokizumab following the phase 3 failure 18 months ago. The company is paying $31 million (€26 million) upfront for the distressed assets relating to the anti-IL-1 beta allosteric monoclonal antibody.

The company have previously garnered FDA approval for Ilaris in two subtypes of the rare auto-inflammatory diseases cryopyrin-associated periodic syndromes in 2009. A large trial in at-risk cardiovascular disease patients with high levels of chronic inflammation also began enrolling patients.

Data presented recently suggest Novartis has succeeded in demonstrating an anti-inflammatory drug can cut the risk of major cardiovascular events so if the company can make the commercial case for Ilaris, its big bet on cardiovascular disease may pay off. Where gevokizumab fits in with the anti-inflammatory portfolio isn’t yet clear.

Update January 7th 2019 by @maverickny

Things are becoming more interesting on the gevokizumab (now VPM087) front.

Novartis have just opened a phase 1 trial exploring the impact of adding gevokizumab to standard of care anti-cancer therapies for metastatic colorectal, gastroesophageal, and renal cancers with different arms for 1/2/3 line therapies.

Initial data are expected year end 2022, so it will be a while before we see what happens in terms of the study readout.

After I wrote my previous blog post about the emerging biotechnology region around Austin, TX, one of the comments I received was about the importance of networking opportunities within a cluster or region.

After I wrote my previous blog post about the emerging biotechnology region around Austin, TX, one of the comments I received was about the importance of networking opportunities within a cluster or region. I was in Austin last week for a business meeting (spot the snow around the State Capitol) and was interested to learn that Austin, TX is an emerging and growing biotechnology cluster.

I was in Austin last week for a business meeting (spot the snow around the State Capitol) and was interested to learn that Austin, TX is an emerging and growing biotechnology cluster.

XOMA 052 is a high affinity monoclonal antibody that targets the inhibition of IL-1 beta. Its ultra-high affinity allows for monthly dosing and lower dose levels which supports patient compliance in chronic diseases. Positive phase 2 results for XOMA 052 in Behcet’s Uveitis was presented in November to the American College of Rheumatology.

XOMA 052 is a high affinity monoclonal antibody that targets the inhibition of IL-1 beta. Its ultra-high affinity allows for monthly dosing and lower dose levels which supports patient compliance in chronic diseases. Positive phase 2 results for XOMA 052 in Behcet’s Uveitis was presented in November to the American College of Rheumatology. Source: Xoma November 2010 Corporate Presentation

Source: Xoma November 2010 Corporate Presentation Intellectual property (IP) rights are important in the biotechnology industry; one only has to look at a licensing, consulting or service agreement to appreciate this.

Intellectual property (IP) rights are important in the biotechnology industry; one only has to look at a licensing, consulting or service agreement to appreciate this.