Galeterone (Tokai Pharmaceuticals) is a new prostate cancer drug in development that has an interesting triple mechanism of action in that like abiraterone (Zytiga) it acts as a CYP17 lyase inhibitor, but it also acts as an androgen receptor (AR) inhibitor and is an AR degrading drug that decreases AR levels.

How effective it is compared to AR antagonists on the market such as enzalutamide (Medivation) or second-generation AR antagonists in development such as ARN-509 (Aragon Pharmaceuticals) or ODM-201 (Orion Pharma) is one of the many unanswered questions with this drug.

This content is restricted to subscribers

The poster (abstract #184) from Tokai scientists presented at the recent 2013 American Society of Clinical Oncology Genitourinary Cancers Symposium in Orlando (ASCO GU) showed preclinical laboratory work using cell lines whereby galeterone was a potent CYP17 lyase inhibitor. It may offer an advantage over abiraterone in not requiring concomitant administration of steroids.

Despite being a clinically focused meeting, no patient data using the new formulation of the drug was presented at ASCO GU; this was disappointing given the potential safety concerns that were raised with the original formulation.

AACR 2012 data showed drug-related rhabdomyolysis & acute renal failure, both Grade 4

Last year at the 2012 AACR annual meeting, Mary Ellen Taplin, MD presented data from the ARMOR1 clinical trial of galeterone in chemotherapy-naïve castration resistant prostate cancer (CRPC).

Of particular concern was the one serious adverse event of drug-related Grade 4 rhabdomyolysis and acute renal failure she reported. Some commentators have dismissed this as a “fluke” but it was clearly taken seriously by the company in the AACR presentation I saw with several slides discussing this and liver safety considerations.

Dr Taplin concluded her AACR presentation by stating that further work was planned to optimize the formulation of galeterone, and that a new phase 2 study with a better formulation was planned for later in 2012.

Critical clinical questions remain unanswered

As Professor Johann de Bono, who was the discussant at AACR 2012 noted, a future trial with galeterone has a number of critical questions to answer:

- Can galeterone achieve sufficient exposure?

- Can galeterone block CYP17? AR? Degrade AR?

- Can galeterone reverse MDV/abiraterone resistance?

So why haven’t I written much about galeterone, as one blog reader recently wrote in to ask? It’s largely because I don’t think there is enough data to make any conclusions yet and both the liver toxicity and rhabdomyolysis issues will overshadow its development until Tokai address this convincingly.

I certainly haven’t seen any pharmacokinetic data on the new formulation to show that safety and efficacy are acceptable, nor any data to show that it has a definite effect on disease progression over and above abiraterone or enzalutamide.

Tokai announced on December 13, 2012 that they had treated the first patient in the Phase 2 ARMOR2 trial, which will evaluate the safety and efficacy of the new formulation.

Hopefully, the clinical data from ARMOR2 will show no repeat of the drug-related grade 4 rhabdomyolysis and acute renal failure seen in the ARMOR1 trial. Only then will we know whether this was a “fluke” or not as some commentators have suggested.

The company has shown a proof of concept but until we see more data, I don’t think we really can assess what potential galeterone may have in the treatment of advanced prostate cancer.

For those interested in the data on galeterone presented at ASCO GU, here’s a link to a PDF of the poster available on the Tokai Pharmaceuticals website.

Galeterone Commercialization Challenges

Some of the challenges that Tokai may face in bringing galeterone to market include:

1. Need for a new formulation has delayed drug development

There are multiple new prostate cancer products in development in what will before long be a much more competitive market than it is today. Although galeterone received a fast track designation from the FDA , I can’t help but think that the company has lost a year as a result of the need to develop a new formulation. Given the market dynamics, this delay could impact Tokai and the potential market opportunity for galeterone.

2. Abiraterone patent expiration is on the horizon

The short patent life for abiraterone and prospect of the availability of a generic version in a few years, could negate some of the advantages of having a CYP17 “combination product”. Galeterone may not require the concomitant administration of steroids, but this benefit may not be sufficiently attractive on its own to justify a premium price when a generic version of abiraterone becomes available.

3. How good an AR antagonist is galeterone?

We don’t yet know how effective an AR antagonist the new formulation of galeterone is. At the scientific meetings I have attended, I have only seen one slide on the mechanism of action, and it’s unclear to me what effect galeterone may have (if any) on AR splice variants. Other questions that come to mind are:

- Is galeterone a more complete antagonist of AR like enzalutamide or does it have antagonist and agonist properties like bicalutamide?

- Will galeterone offer benefits over using an AR antagonist such as enzalutamide in combination with abiraterone?

- Are the AR antagonist effects of galeterone better than second-generation AR antagonists in development such as ARN-509, ODM-201?

4. Randomized registration trials will need to be done against the standard of care

If your registration trial is not already underway, the days of placebo controlled trials in advanced prostate cancer are over. It would be unethical to give men an inactive placebo when effective new therapies are already available, especially in the post chemotherapy setting. Tokai will most likely have to do a randomized registration trial of galaterone against abiraterone. Will it be superior or only equivalent in efficacy and tolerabilty?

5. To charge a premium price, Tokai will need to show men live longer

The competitive landscape is moving fast, and I predict as the cumulative cost of prostate cancer treatment increases, the market will become more price sensitive as new drugs are approved. If Tokai desire to charge a premium price, then they will need to show that galeterone is superior to the standard of care i.e. men live longer when taking it compared to taking abiraterone or enzalutamide.

Abiraterone had the first mover advantage as the first drug to seek approval in the pre-chemotherapy CRPC setting. Johnson and Johnson obtained FDA approval based on the totality of the COU-AA-302 trial data, which included the absence of a significant overall survival advantage, although this would most likely have been reached had the trial not been stopped early. In future, I can’t see other companies being equally blessed. Medivation will most likely run their PREVAIL trial until a significant overall survival advantage is obtained, and in the process raise the bar for future competitors such as galeterone.

Other combinations may offer more benefit than galeterone

It is good news for men with advanced prostate cancer that new treatment combinations are on the horizon. While I remain sceptical about galeterone, at least until they show compelling clinical data, I am excited about new treatment options such as radium-223 (Alpharadin) that will soon be approved by the FDA.

Professor Bertrand Tombal in his recent ASCO GU interview with Sally Church, PhD said the trial he’d most like to do is radium-223 + enzalutamide. I share his enthusiasm for this. If you haven’t already read the interview, here’s a link to it on Pharma Strategy Blog.

While I didn’t think galeterone was worth writing about from AACR 2012 given that it was headed back to the lab for a new formulation, a novel prostate cancer treatment that did catch my attention was AZD3514 from AstraZeneca. Here’s the link to my AACR 2012 post in case you missed it. This is one that I am watching, and I hope there will be phase 1 clinical trial data for AZD3514 at the ASCO annual meeting later this year.

My Conclusion

In my view, Tokai Pharmaceuticals have yet to show the new formulation of galeterone is safe and effective or that men with advanced prostate cancer live longer when taking the drug compared to taking abiraterone or enzalutamide either sequentially, or in combination. While galeterone may offer an innovative mechanism of action, it is too early to say whether this will translate into any meaningful clinical benefit in the treatment of advanced prostate cancer or whether it’s just another me-too drug in development.

The share price of Exelixis ($EXEL) is starting a run-up (after months in the doldrums) in advance of anticipated results from the COMET-1 phase 3 trial in metastatic castrate resistant prostate cancer (mCRPC) for cabozantinib (Cometriq, formerly XL184).

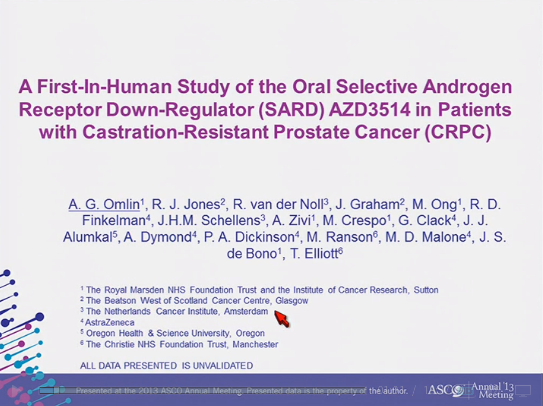

The share price of Exelixis ($EXEL) is starting a run-up (after months in the doldrums) in advance of anticipated results from the COMET-1 phase 3 trial in metastatic castrate resistant prostate cancer (mCRPC) for cabozantinib (Cometriq, formerly XL184). The results from a first-in-human clinical trial with in men with CRPC were presented by Dr Omlin at ASCO 2013 (

The results from a first-in-human clinical trial with in men with CRPC were presented by Dr Omlin at ASCO 2013 (