Boston – One of the most enjoyable things about writing about science and early clinical oncology data is the relationships we build with thought leaders, such that they can be open and honest about their reactions, without them being judged, misinterpreted, or misquoted. We’re on a journey with them, whatever the ups and downs might bring, in a bid to capture the realities of the oncology R&D rollercoaster.

Don’t be fooled by the gloomy Boston weather as a metaphor for data presented at Targets19!

Each story becomes a snapshot in time, a short of ‘Kodak moment’, if you will.

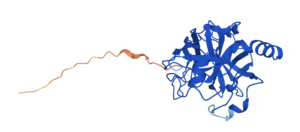

Imagine then, capturing a discussion with a global lung thought leader discussing the initial data from the first-in-man trial with a KRASG12C inhibitor from Mirati (MRTX849) and his experiences in treating people with advanced lung cancer who have the dreaded KRAS mutation, which until recently there were no effective options for.

Thus, we captured the exuberance of seeing objective responses in patients for the first time, “It’s fantastic!” and at the same time qualifying that with a balanced and candidly objective perspective, “it’s still early days.”

Both are true, and not mutually exclusive.

In between these two extremes there is much to think about including understanding the inevitable resistance mechanisms that evolve (primary and secondary), figuring out how to optimize the combination trials as well as reactions to other, seemingly competitive, developments. Our expert in the hot seat today had some rather thought provoking ideas on these important topics to discuss that we wanted to share and stimulate some debate on.

To learn more from our oncology coverage and get a heads up on insights from our latest thought leader interview, subscribers can log-in or you can click to gain access to BSB Premium Content.

This content is restricted to subscribers

In this latest article, we highlight ten areas within the niche and include an array of companies, both big and small, across Pharma and Biotechs.

In this latest article, we highlight ten areas within the niche and include an array of companies, both big and small, across Pharma and Biotechs.